Takeprofit Bridge has been serving brokers since 2013. The bridge you allows to:

- Connect to any trading platform and any liquidity provider.

The bridge natively works with 50 liquidity providers and the most popular trading platforms. Any trading platform or FIX API maker can be added upon request. - Onboard new brokerage clients in just 30 minutes.

Once all credentials are provided, our tech support team needs only half an hour to set up your new taker. - Use “Margin Accounts” to provide each of your clients with a dedicated trading wallet.

The bridge lets you assign a separate account to every FIX client, where they can view balance, equity, margin, credit, position history, and a market-watch window — and even trade directly from that account. - Use “Market Watch” to view all bridge symbols with full market depth.

You can browse the list of symbols, inspect detailed depth for a selected symbol, and see a visual representation of this data on the chart. - Use “Events” to dynamically react to market news and adjust spreads during news periods.

Create a rule with your desired markup, set the time interval — and spreads will automatically update according to your schedule.

Aggregation Modes

Simple aggregation

The bridge can select the best price among active liquidity providers and sends the full order to that liquidity provider.

Advanced aggregation

The bridge can split the order volume across multiple liquidity providers according to available price levels — then confirms execution from each one.

Order a free demo setup

Test Takeprofit Liquidity Bridge free for two weeks.

Our technical support team will handle the installation for you. Or you can set it up yourself using our step-by-step documentation.

Monitoring and Risk Management Tools

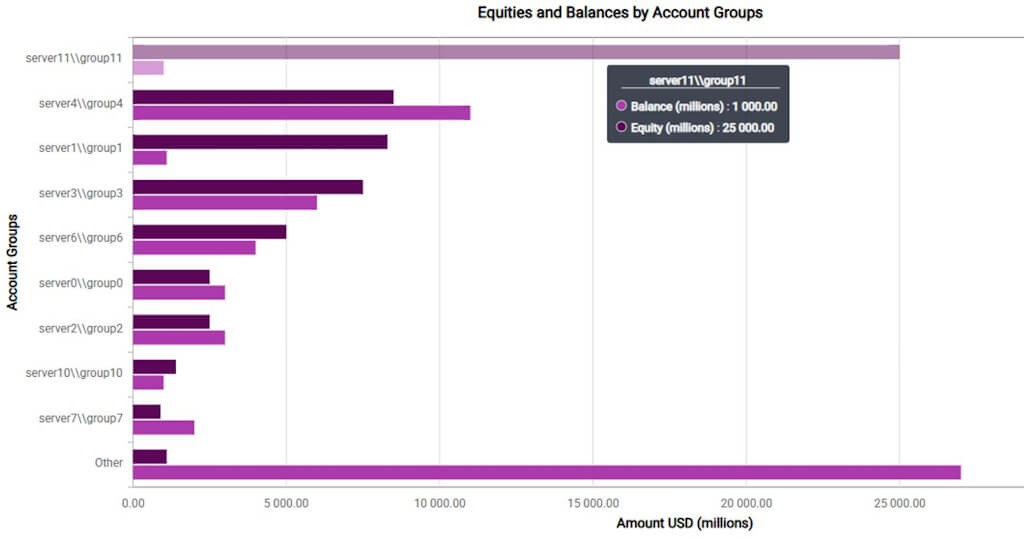

Track your real-time performance with dashboards covering orders from consumers / to providers, books from providers / towards customers, errors, execution latency, profit and loss analytics, client equity and balance metrics, top winners and losers, and additional risk indicators.

More Features

- You are able to fine-tune flexible trade execution by configuring delays, slippage, and markups. This gives you precise control over execution behavior under different market conditions.

- The bridge provides hedging strategies with coverage multipliers and reverse trading. This allows you to adjust your risk exposure and adapt to changing market dynamics.

- With the bridge you can execute trades in both A-book and B-book modes. This dual-mode setup lets you define execution rules per symbol, group, or client to optimize exposure and profitability.

- The solution provides “Emergency Failover for Trading Instruments”. If a price for a symbol is not updated for more than 30 seconds, the bridge switches to the next available liquidity provider for that symbol. Failover applies separately to each symbol — only the affected symbol is switched, while others continue to operate normally.