Ashira Dealing Desk is designed for:

- Managing trade execution conditions for clients.

- Mitigating trader advantages arising from scalping, news trading, and high-speed Expert Advisors.

- Benefiting from 24/7 customer care provided by a team with 13 years of experience in dealing solutions and server health management.

Order a free demo setup

Test Ashira Dealing Desk free for two weeks.

Our technical support team will handle the installation for you. Or you can set it up yourself using our step-by-step documentation.

Why Retail Brokers Choose Ashira

Takeprofit Tech’s Dealing Desk has been trusted by retail forex brokers since 2013. Here is why:

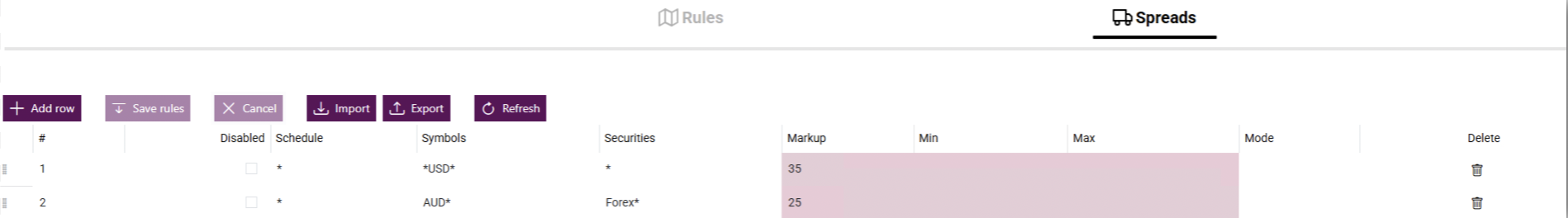

Markup management

Retail brokers typically rely on markups rather than commissions. Using our dealing desk you can set different markups for different symbols according to a timetable. As well as you can markup spreads during news.

Ability to pass trades to execute manually

The ability to execute trades manually is important because it gives dealers control in exceptional situations — for example, when automated rules may not account for sudden market changes, liquidity gaps, or abnormal client activity.

It ensures decisions can be made with human judgment when needed.

Support of instant execution

This option provides traders with immediate order confirmation at the quoted price, ensuring smoother trading experience.

Market-like behaviour setup with Excel-like interface

You can set execution conditions, including slippage, delay, etc, that reflect real market conditions, giving traders a realistic experience. This helps brokers maintain credibility.

Market depth simulation

Market depth can be simulated by setting multiple execution rules for different order sizes with varying slippage.

Smaller trades will experience minimal slippage and delay, while larger orders will be executed with greater slippage and latency — reflecting how execution typically behaves at liquidity providers.

Setup against news traders

Ashira can be configured to counter news trading by adding a general rule that applies a small random delay to all orders, ensuring stop orders execute at the actual market price rather than the requested one.

Additional rules can increase delay or slippage for specific order types or clients, creating more realistic execution during volatility and preventing latency abuse.

All order types support

Ashira works with all key order types — market orders for opening and closing trades, pending orders, stop-loss and take-profit activations, as well as stop-out events.

This ensures full control and consistent execution logic across the entire trade lifecycle.

Want to Learn More About Dealing Options?

Book a call and discover how Dealing Desk by Takeprofit Tech works.

Our team will walk you through real use cases and show how Ashira can be tailored to your brokerage’s trading model.

Email and Telegram support during business hours

24/7 emergency assistance hotline

Updates to ensure that the dealing desk works with the latest version of your trading platform

Developers dedicated to enhancing the dealing desk to meet your business needs