MT4 bridge or MetaTrader bridge connects the MetaTrader 4 trading platform with liquidity sources, ensuring real-time pricing and trade execution.

Forex brokers and liquidity providers that operate on a non-dealing desk (NDD) model use MT4 bridge software to route client orders directly to liquidity providers instead of executing trades internally.

MetaTrader bridge acts as an intermediary layer between the MT4 server and external trading infrastructure.

What MT4 Bridge | MetaTrader Bridge Does

- Delivers liquidity by providing real-time price feeds from liquidity providers to the MT4 trading platform

- Executes trades by routing orders from the MT4 platform to liquidity providers for processing

- Manages execution parameters, including slippage, latency, markups, and order handling rules

Two Types of MT4 Bridge

Not all MT4 bridges are built the same. The main difference between bridges is how they communicate with liquidity providers.

Proprietary MT4 bridge

Many “classic” MetaTrader bridges use proprietary connectors or vendor-specific APIs to connect MT4 to liquidity providers. They perform the same bridge pricing and execution functions, but the connectivity layer is not standardized across liquidity providers.

This approach can work well, but brokers may face limitations in:

- execution transparency

- flexibility of routing logic

- ease of connecting multiple LPs

- or latency optimization

MT4 FIX API bridge

An MT4 FIX API bridge is not a different product category.

It is an MT4 bridge that uses Financial Information eXchange Application Programming Interface. This interface provides a single connectivity and execution protocol between the bridge and liquidity providers, playing a crucial role in optimizing integrations for MT4 brokers.

In practice, FIX API results in better connectivity and flexibility.

- Better connectivity. The FIX API provides standardized, reliable, and fast communication channel between the MT4 trading platform and liquidity providers.

Unlike traditional MT4 bridge, the MT4 API bridge enables direct trade execution, reducing latency and enhancing order flow efficiency. - Flexibility. FIX API technology allows brokers to customize order routing, manage risk dynamically, and access multiple liquidity pools without being limited by the constraints of MT4’s internal trade processing.

Additionally, it supports advanced trade management functions, such as partial fills, hedging, and multi-asset execution, ensuring greater control over order execution. For brokers looking to optimize performance, increase execution transparency, and improve overall trading conditions, an MT4 API bridge is an indispensable solution.

The core difference

In short, FIX doesn’t replace the MT4 bridge concept — it strengthens it by providing a robust, widely supported connectivity standard.

MT4 bridge = the function (connect MT4 to liquidity/execution)

MT4 FIX API bridge = the way to implement that function (using FIX)

Popular MT4 Bridge Providers

Several MT4 bridge providers are widely recognized in the forex industry for their reliability and long-standing market presence. Well-known names include OneZero, PrimeXM, Tools for Brokers, and Takeprofit Tech, each offering MT4 bridge solutions with different levels of customization and infrastructure support.

These MT4 bridge providers cater to fx brokers of various sizes, from startups to large institutions. While their core purpose is similar, their pricing models, feature sets, and integration capabilities differ. As a result, brokers often compare providers based on specific operational and business requirements.

MetaTrader Bridge vs MT5 Gateway

Brokers typically select the trading platform first, and the connectivity layer is largely defined by that choice: MT4 setups rely on a bridge, whereas MT5 uses a gateway model. Therefore, the goal is not to “pick a bridge or a gateway,” but to understand what each architecture implies for operations, configuration effort, and execution workflow once the platform is chosen.

Symbol configuration

One example is the initial symbol configuration, which can be particularly time-consuming. A bridge works with three separate symbol lists: one from the liquidity provider, one from the trading platform, and an intermediate list within the bridge itself. To enable trading, these lists must be accurately mapped to each other, often requiring considerable effort from the broker. However, this complexity comes with a clear advantage — the ability to fine-tune a wide range of parameters at every stage of the symbol configuration process.

With a MT5 gateway, symbol configuration is generally more straightforward than in bridge-based setups. The gateway typically maps symbols directly between the MT5 platform and liquidity providers without introducing a fully independent symbol layer. This reduces configuration effort and operational overhead, although it also limits the level of granular control available compared to a bridge-based architecture.

Routing

When using a gateway, trades are routed from the trading platform to the liquidity provider through the gateway as a single integration layer. On the platform side, routing rules determine how the trade is handled before it is passed to the gateway, which then forwards the order to the liquidity provider. Compared to bridge-based setups, this flow avoids additional aggregation layers and reduces the number of intermediate processing stages.

MetaTrader bridges, on the other hand, function differently. They act as an additional layer between the trading platform and the liquidity provider. Once a trade is created, it typically passes through a gateway or an MT4 plugin, exits the trading platform, and enters the bridge. From there, the trade request is forwarded via a FIX session to the liquidity provider for execution. This extra stage in the transaction flow can impact performance, particularly when processing pending orders.

Execution workflow

In a bridge-based MT4 setup, execution logic is largely handled outside the trading platform. Orders are created within MT4, extracted via plugins or gateways, processed by the bridge, and then forwarded to liquidity providers, often via FIX. Execution confirmations must then be translated back into MT4’s internal order model. This multi-stage workflow increases flexibility but also adds operational and technical complexity.

With a third-party MT5 gateway, execution remains more closely aligned with the MT5 platform’s native order model. Although the gateway is an external component, it operates as a direct execution interface rather than a full middleware layer. As a result, the order lifecycle is shorter and more consistent, with fewer translation steps compared to MT4 bridge environments.

MetaTrader Bridge from Takeprofit Tech

Takeprofit MetaTrader Bridge is a liquidity aggregation, order and risk management solution with 24/7 customer care.

Takeprofit MT4 bridge connects several liquidity providers to the MetaTrader trading platform, ensuring aggregation of receiving data. This way, you may achieve the best trading conditions for your clients, providing them with the tightest spreads and enticing prices.

It also offers a wide range of risk-management tools, including monitoring and risk-management dashboards for tracking performance metrics, PnL, account-level statistics, and trader profiles, as well as tools for detecting abnormal profits and losses, flagging high-leverage abuse, and analyzing exposure.

- Takeprofit MT4 bridge software supports 35 liquidity providers, including 5 most popular crypto exchanges: Binance, Bitfinex, Okcoin, Kraken, Alpaca. We will add any new liquidity provider per your request.

- Takeprofit MT4 API bridge offers A-book, B-book, and hybrid trade execution. It enables the creation of multiple groups of traders to execute high-performing traders on your liquidity provider while processing the other groups in-house.

- The bridge is WL-friendly. Each white-label broker can have their own liquidity bridge with independent liquidity provider and symbol configuration.

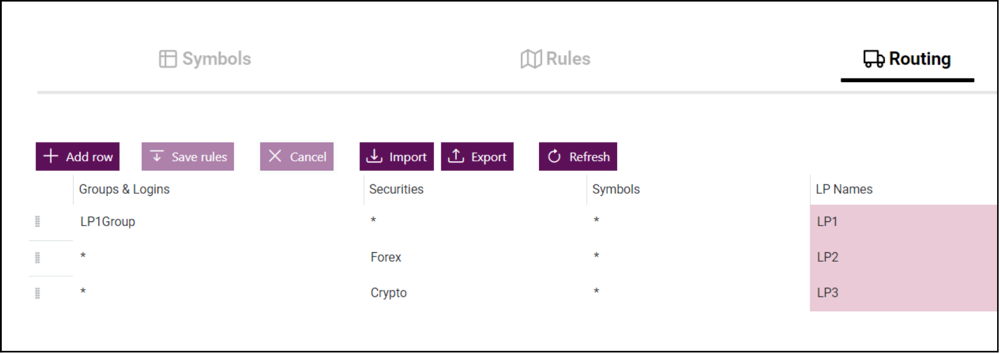

- The bridge provides an Excel-style configuration tool for setting up execution and routing rules, allowing you to apply slippage, delays, and markups as needed. As a result, when clients view prices in the market watch, they see rates that already include your markups:

- With the Takeprofit MT4 Bridge, you are not limited to just one trading server. Instead, you can connect all your trading servers and liquidity providers to a single liquidity aggregation platform and manage all parameters from one place.

Get a Free Trial of MT4 Liquidity Bridge

You are welcome to get a tech consultation and a trial of the Takeprofit MT4 Liquidity Bridge. Fill in the form and we will respond to you within one business day.

Support of MT4 Bridge Software

Email and ticket support during business hours

Emergency 24/7 support hotline

Updates to ensure that the solution works with the latest version of MetaTrader platforms and Windows

Developers devoted to finding solutions to your personal needs

Installation of MT4 Bridge Software

Our customer care team installs the bridge during one day or you can install it yourself using the guidelines. Your account manager will also assist you to ensure smooth and efficient operations.FAQ on MetaTrader Bridge

What brokers need a MetaTrader bridge?

Any broker looking to enhance execution quality, provide direct market access, and improve liquidity management needs a MetaTrader bridge. Here are the key types of brokers that benefit from using a bridge:

- STP (Straight-Through Processing) brokers. STP brokers route orders directly to liquidity providers without internal dealing desk intervention.

- ECN (Electronic Communication Network) brokers. ECN brokers connect traders directly to a network of liquidity providers, banks, and institutional participants. MetaTrader bridge helps them to integrate multiple liquidity sources, ensuring tighter spreads and deeper market depth.

- Hybrid (A-Book/B-Book) brokers. Some brokers operate a hybrid model, executing larger clients’ trades via STP (A-Book) while internalizing smaller trades (B-Book).

A bridge allows brokers to automate order routing based on risk management strategies. - Institutional brokers. Prime brokers, hedge funds, and liquidity providers offering MetaTrader solutions require a bridge for high-speed execution and FIX API integration. The bridge ensures ultra-low latency execution, a critical factor for high-frequency trading (HFT) and professional traders.

- Forex & CFD brokers expanding liquidity access. Brokers looking to offer competitive pricing and multi-asset trading need a bridge to access multiple liquidity providers.

A bridge aggregates liquidity, ensuring better order execution and market stability.

What is the price for MetaTrader bridge?

The cost of a MetaTrader bridge varies depending on the provider, features, and specific requirements of the brokerage.

Pricing structures typically include setup fees, monthly subscription charges, and potential additional costs based on trading volume or the number of connected liquidity providers.

For instance:

Takeprofit MetaTrder Bridge offers a pricing model with a minimum monthly fee of $1,499, plus $1 per million dollars of trading volume for both A-book and B-book executions. We also provide a two-week free trial for evaluation purposes.

What are the most popular MT4 API bridges?

The most popular MT4 liquidity bridges are those from OneZero, PrimeXM, Gold-i, and Takeprofit Tech.

There much more MT4 API bridges on the market for any business needs. However, those above are the most reliable and reputable.

How do MT4 bridge providers ensure compliance with regulations?

Reputable MT4 bridge providers offer compliance features such as trade reporting, audit trails, and integration with regulatory reporting systems to help brokers meet financial regulations.