The COVID-19 has transformed the year 2020 into the perfect storm, and the economy reflected it in the form of an extraordinary crisis. Deloitte, a multinational professional services network, responded to this challenge by describing three scenarios to be used as a guide through the end of 2021. The economic cases discussed in this review can help brokers to understand consumer attitudes and trader behavior so as to adjust their marketing activities and prepare their business to the changes.

Deloitte states that strategic planning based on these scenarios helps organisations and executives to prepare and withstand difficult economic situations and take advantage of the opportunities inherent in them.

Many countries’ leaders all over the world had to take strict measures to make business safe in order to counteract COVID-19. At the same time, several countries were unable to stabilize their economies, foredooming them to economic breakdown.

Taking this situation into account, Deloitte proposed a specially designed recovery framework to aid governments and support businesses so that they would successfully cope with these incredibly unpredictable times. It contains three dimensions:

- Respond, help to meet the challenge of the crisis.

- Recover, help to recover.

- Thrive, help to achieve success after the COVID-19 pandemic is over.

Thus, Deloitte has developed three tenable scenarios for the global economy, each of which can be used depending on the pattern that the pandemic follows. These scenarios are associated with the monitoring of economic and financial statistics:

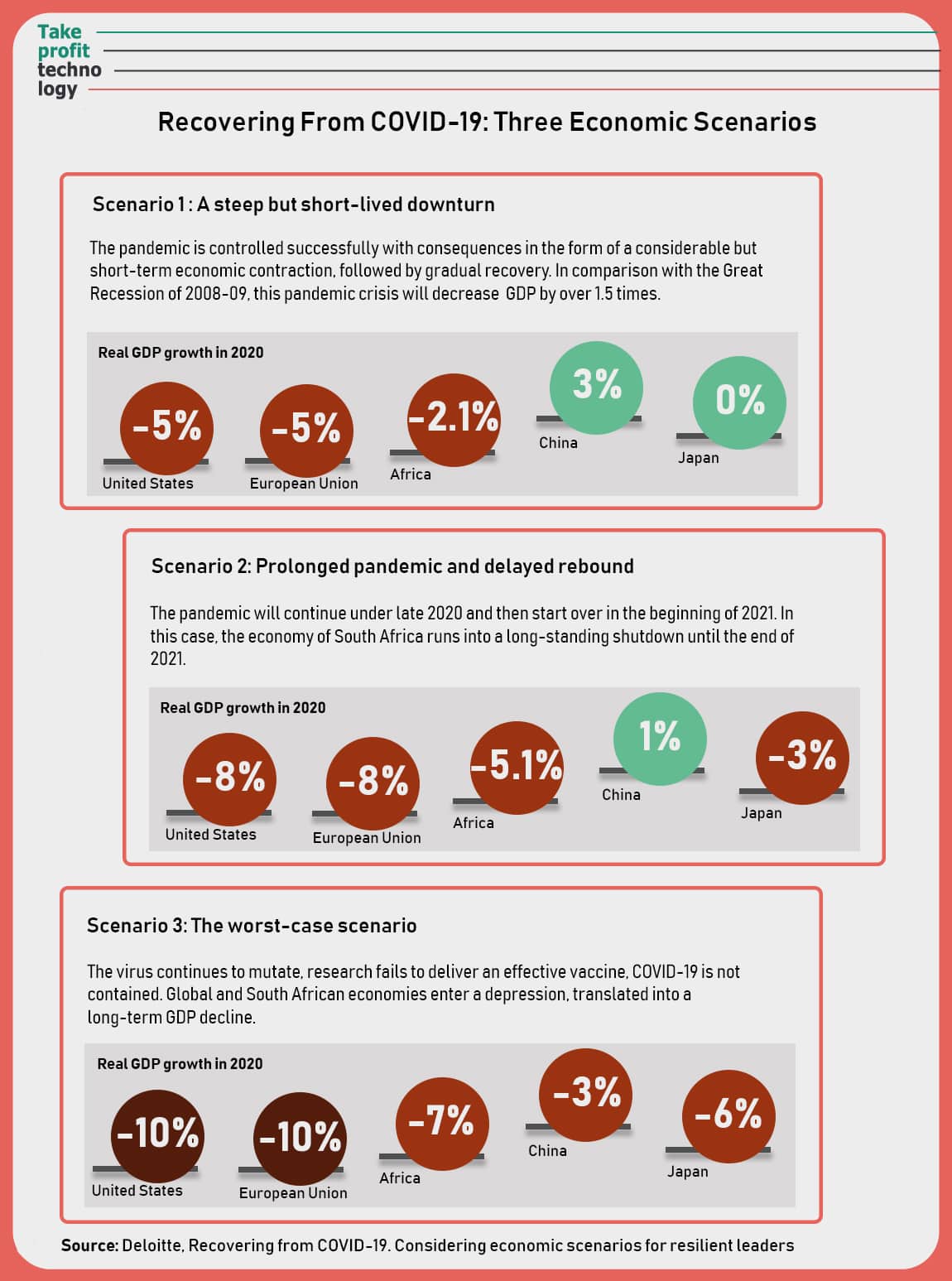

Scenario 1: A Steep But Short-lived Downturn

In the beginning of the pandemic, Deloitte presumed that the pandemic may slow down sooner than experts suggested, and the combination of effective government measures with increased testing volumes could lead to a reasonably fast recovery of the economy.

The anticipated consequences of the pandemic:

- E-commerce receives a boost, and the retail sector is altered forever.

- Rebound of the global economy starts in early 2021.

- Starting in mid-2021 the recovery speeds up due to greater consumer confidence. Global economy growth drops to zero, and US economy growth is reduced to 5%.

- Commodity exports are slated to decrease in Q2 to recover in the end of the year.

- Due to drawdown of demand for industrial goods, non-commodity exports decrease significantly.

- US and EU recessions are serious, but fast. Small and medium-sized businesses are damaged on a disproportionate scale.

- Significant fiscal support programs in the EU and the US help reduce damage to the global economy.

- Exports are curbed by continued low demand and business investment.

- The stock market correction during the downturn leads to negative wealth and higher debt burden in consumers.

Scenario 2: Prolonged Pandemic and Delayed Rebound

Deloitte’s next version of the course of the pandemic forecasts waves of infection throughout 2020 and early 2021 that keep the world in crisis mode. This case provides for an expected combination of a sustained recession with weak supply and demand and financial system shocks. The countries that faced these challenges earlier and reacted uncompromisingly go back to normal life faster.

The anticipated consequences of the pandemic:

- A tendency for companies with funds to invest to spend their resources on AI, robotics and other technologies, reducing human labour.

- Western economies face a deep and sustained recession, which instantly reflects on consumer demand and supply chains.

- Demand declines all over the world, and the financial stress is similar to that of the Great Recession of 2008-09.

- The end of recession is expected in early 2021. Beginning of economic recovery is expected in early 2022.

- Commodity prices fall because China’s economy recovers at a slower pace than expected.

- Production costs grow, and competition diminishes, which leads to inflation in the supply chain.

- Serious decline is expected in manufactured exports.

- The public sector, which is already experiencing fiscal instability, is under serious stress due to a quick drop in GDP.

- Interest rates are expected to stay at present lows until the second half of 2022.

- Banks’ balance sheet is under strain due to an increase in defaults.

- The economy is in an uncertain and unsteady situation with no short-term recovery in sight, which will lead to recovery of equities in the beginning of 2021 and their subsequent decline.

Scenario 3: the Worst-case Scenario

The last option of getting through the pandemic, as Deloitte predicted, involves the world allowing the virus to cycle and mutate over time. Under such circumstances, significant parts of the global economy can move from economic recession into a state of depression despite the most aggressive fiscal and monetary interventions in history.

The anticipated consequences of the pandemic:

- Despite uncertainty, adoption of technology grows.

- Efforts of the central bank fail due to enormous numbers of defaults, and the financial system breaks down, especially in emerging markets.

- Private consumption decreases, many businesses shut down and households experience problems and accumulate large debts.

- Nationalisation of industries is extended despite government efforts to maintain production.

- The global economy faces a major contraction of demand that does not allow it to recover until early 2022.

- Global depression in leading economies triggers at least a 10% drop in GDP for two or more years.

- Commodity exports continue to decrease due to exhaustion of the capital stock.

- Manufactured exports are significantly reduced.

- High volatility in fuel, food, shelter and discretionary goods sectors does not help to steady inflation, deflation continues.

- The economy is finished off by net export balance.

- Serious strain falls on the public sector fiscal accounts.

Final Words

Deloitte proposed different versions of our seemingly infinite macro-economic uncertainties in the pandemic times. According to the forecast, certain upside opportunities and downside risks have emerged, and others can occur. And whether they manifest depends on the actions of governments, global organisations and business, among other things.

Read more:

5 Scenarios of Collaborating with Influencer Traders

How to Create a Trader Journey Map